2020 AR Tax Forms for Down syndrome

January 15, 2021

Did you know…

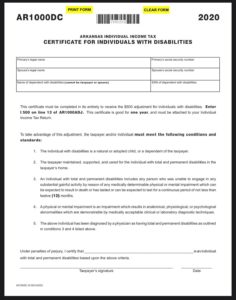

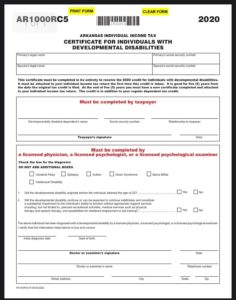

…most families who claim a dependent with Down syndrome in Arkansas can also claim 2 (two) $500 tax credits on their AR state income taxes? It’s true. Don’t take our word for it, we’re not tax advisors but do ask your tax professional if your family qualifies for these deductions.

Learn more on the Arkansas State Income tax website here: https://www.dfa.arkansas.gov/income-tax/individual-income-tax/forms/

Click on the images of the forms below to be directed to the Arkansas Income Tax website for a printable PDF.

Recent Posts

Fact Friday: Individuals with Down syndrome ARE employable!

Myth: People with Down syndrome are unemployable Facts to disprove myth: Individuals with Down syndrome can be excellent employees. The Global Down Syndrome Foundation explains...